5 ChatGPT asks that you apply Rich Dad Poor Dad to your personal finances

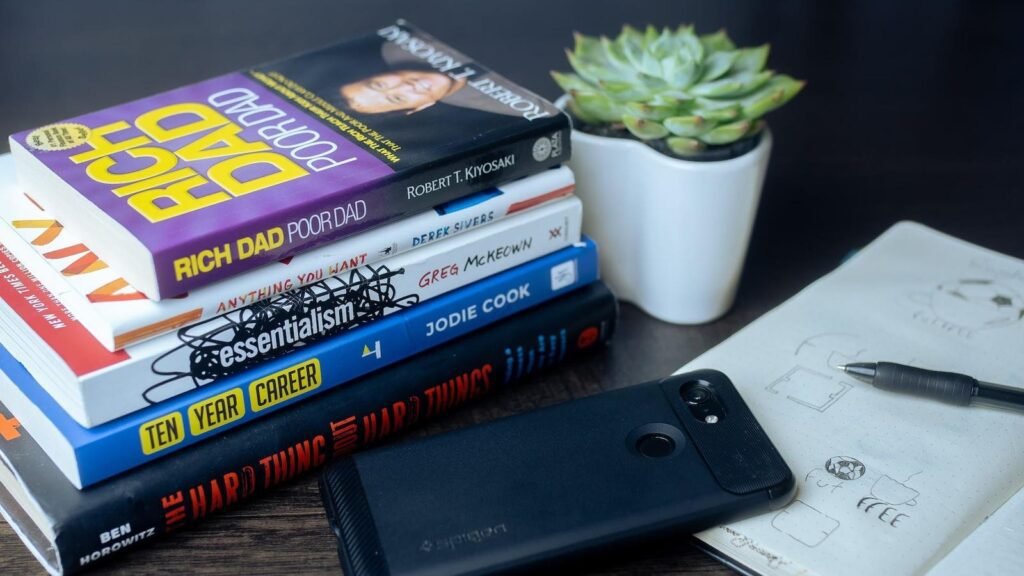

Robert Kiyosaki’s book Rich Dad Poor Dad has become a preeminent book on personal finance since its publication in 1997, selling over 32 million copies in more than 51 languages in 109 countries. It contrasts the financial philosophies of Kiyosaki’s two father figures, his own father, the ‘poor dad’, and his best friend’s father, the ‘rich dad’. Through these lenses, Kiyosaki presents theories on investing, real estate, wealth creation, and increasing financial intelligence.

With unconventional wisdom about money and investing, his principles have important implications for personal finance entrepreneurs. Could you escape the rat race faster than everyone you know? Applying the teachings from this book can make it possible. Use these 5 prompts in the same ChatGPT window, edit the brackets to explain your context, and begin the journey of turning the 5 main lessons into practical business strategies.

Rich Dad Poor Dad: ChatGPT asks to apply its lessons

Establish your financial education

School didn’t teach you about finances, and your parents might not have. Inflation, borrowing, interest rates, owning a home, investing and saving are concepts that take on very different meanings depending on who is explaining them. This means assuming the teacher’s limiting beliefs and financial illiteracy, unless you are deliberately pursuing an unbiased definition. Use ChatGPT to apply the concept of Rich Dad Poor Dad financial education to your existing situation, whatever money decisions you are about to make. Let go of the outdated things you’ve been taught about money, because they may not be serving you right now.

“I have been influenced by various teachings and beliefs about finances from school, family and society, which may not align with current financial wisdom. Based on the principles of financial education from ‘Rich Dad Poor Dad,’ can you provide guidance on how to approach and review key financial concepts such as inflation, borrowing, interest rates, home ownership, investing and saving?My current financial situation includes [describe your current financial situation or upcoming money decisions]. Help me shed any outdated beliefs you suspect I may have and apply practical, informed financial strategies to my situation. The goal is to gain a clearer, more effective understanding of managing and growing my finances in today’s economic environment.”

Understand assets and liabilities

Kiyosaki defines assets as things that put money in your pocket (such as investments or real estate that generate income) and liabilities as things that take money out of your pocket (such as debt or expenses). He said the rich buy assets while the poor and middle class accumulate liabilities. Understanding the difference is key. The book explains that, contrary to popular belief and media manipulation, a home you own is a liability, not an asset. Dispel any myths you may be holding and understand how what you own and do breaks down into assets and liabilities according to Kiyosaki’s teachings

“Based on Robert Kiyosaki’s definitions in Rich Dad Poor Dad, I would like to categorize my financial holdings into assets and liabilities. Here is a breakdown of my financial information: [provide a detailed list of your financial holdings, including investments, properties, debts, expenses, etc.]. Analyze this information and classify each item as either an asset (something that puts money in my pocket) or a liability (something that takes money out of my pocket), according to Kiyosaki’s teachings. This analysis will help me better understand my financial situation and guide me in making decisions that align with accumulated assets rather than liabilities.”

Work for assets, not money

Kiyosaki believes that the middle class works for money (wages and salaries), but the rich have their money work for them through investments, businesses, and other income-generating ventures. What are you doing; Based on what it knows about your situation so far, ask ChatGPT to suggest ways you could change your efforts and ensure your money is working for you, not the other way around. Apply the book’s teachings to make real change, starting with this simple prompt.

“Following the Rich Dad Poor Dad principles, I am interested in changing my focus from working for money to having my money work for me. Based on what you know about my current financial situation and assets data [briefly recap your current financial situation and assets], can you suggest ways I could refocus my efforts to create investments or income generating ventures? I’m looking for practical advice on transitioning from primarily earning through wages and salaries to generating passive income through investments, businesses or other means. The goal is to apply Kiyosaki’s teachings to initiate real change in the way I manage and grow my finances.”

Plan to escape the rat race

Most people are stuck in the rat race. As their income increases, so do their expenses. They depend on their monthly salary and depend on their job to maintain their lifestyle. Earning and spending this way is a trap. The Rich Dad Poor Dad Method can help you break out of this cycle and work towards real wealth. Use this prompt to calculate how much money you need to build your assets to become financially free faster. You may be closer than you think.

“According to Rich Dad Poor Dad principles, I want to break free from the rat race by having my assets generate enough income to cover my expenses. This is my current monthly income: [insert monthly income]income from assets: [insert asset income]and my monthly expenses: [insert monthly expenses]. Based on these figures, calculate how much more I need to produce my assets each month to achieve financial freedom. The goal is to determine the point at which the income from my assets exceeds my expenses, allowing me to be financially independent from my regular income from work.”

Cultivate an entrepreneurial mindset

Traditional employment will not really make you rich. Kiyosaki advises that instead of looking for a regular job with a monthly salary, you should consider becoming an investor or entrepreneur. Maybe you keep your job but funnel your income into assets to escape the rat race and not need your paycheck. This path is the only way to control your financial destiny. If you already have a business, you just need to grow it and make it earn more money to spend on assets or reinvest for further growth. Either way, cultivate an entrepreneurial mindset and see what you can achieve.

“I’m inspired by Rich Dad Poor Dad to further develop my entrepreneurial mindset and gain more control over my financial destiny. Can you recommend specific strategies to expand and optimize my current business [describe your business] increase its profitability? I am interested in ways to enhance income generation and invest in assets that can provide passive income. In addition, you provide information on how to effectively reinvest profits to stimulate further business growth and wealth accumulation. The goal is to improve my approach to entrepreneurship, focusing on building wealth through smart business operations and investments.”

Rich Dad Poor Dad: ChatGPT asks to apply its lessons

Apply the teachings from this popular book and transform your finances one idea at a time. Brush up on your financial literacy, revisit jargon you may have misunderstood, and get new ideas for the way forward using these five prompts. Establish your financial understanding, including categorizing your assets and liabilities in the most useful way, then understand how to work for assets instead of money. Make your plan to break out of the rat race and make sure your mindset doesn’t hold you back. Many people have benefited from this bestselling book, now it’s your turn to try the methods.