The profit motive does not wait for permission to innovate. It is essential to remember this with the Bank Secrecy Act in mind.

The legislation was passed in 1970 to help the federal government prevent money laundering and other financial crimes. Among other things, banks are required by law to generate “currency transaction reports” for cash transactions north of $10,000, along with “suspicious activity reports” of $2,000 to $5,000, depending on the circumstances.

Reflecting on the rules, it’s not enough to point out that $10,000 in 1970 meant a lot more literally and figuratively than $10,000 in 2025. Which means we can thank Streamlining transaction reporting and ensuring anti-money laundering improvements for a new era law. The legislation, introduced by Senators Tim Scott (R-SC) and John Kennedy (R-LA), aims to bring a 55-year-old law to 21St century with amended currency transaction reporting requirements that increase the cash numbers from $10,000 to $30,000, $2,000 to $3,000, and $5,000 to $10,000.

It will be said again that the legislation represents progress, but it will be said again that the Bank Secrecy Act is 55 years old. Stop and think about it, and think about it, please think about how much the movement of money has modernized since the 1970s. It’s not just that money in amounts of $10,000 and/or $30,000 has long been moving with increasing frequency at the click of a mouse. Internet-inspired banking is certainly amazing, but to reduce money movements to computer images is to reveal yourself as somewhat stuck in the past.

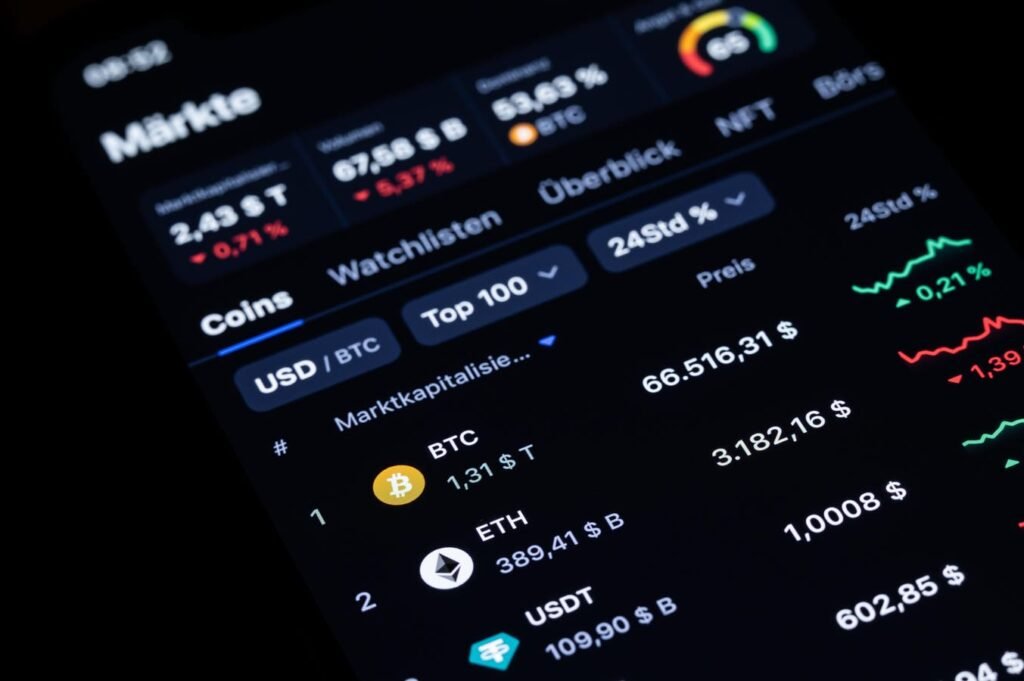

To see why, consider how money might move in 2025. In particular, consider money transfers via cryptocurrencies of the stablecoin variety.

Not only did crypto brokerages quickly work around the legal hurdles that allowed them to pay interest on stablecoin deposits (all that was needed to circumvent the law was to convert the interest paid on the deposits into “rewards” paid on the deposits) so that they could perform banking functions without the rigors of banks, but it is important to consider the movement of virtual of coins. When we think about it, it’s easy to see the calcified nature of not only the Bank Secrecy Act, but its modern replacement.

While Senators Scott and Kennedy’s efforts to bring logic and reality to a very old law again fall flat, it is important to think about their legislation while fully aware of the 2025 truth that stablecoins can be sent anytime, anywhere without any of the rules that banks work with. Translation, cash in much larger amounts can move within the crypto universe at high speed and at low cost.

It’s just a comment that as banks are “allowed” loose rules on cash transfers, digital money transfers that match one-to-one with dollars make the legislative convenience arguably more stringent than the Bank Secrecy Act itself. Banks clearly want to compete, but regulatory limits increasingly make banks’ competitive efforts like playing basketball, soccer or golf with one hand tied behind their back.

All this requires a review of the legislative limits generally placed on banks. As the proliferation of cryptocurrencies makes clear, the profit motive is quickly erasing the value and effectiveness of bank-specific rules. Worse, the legislation limits banks’ ability to respond to their customers’ needs. This is what political and regulatory barriers to achievement generally do.