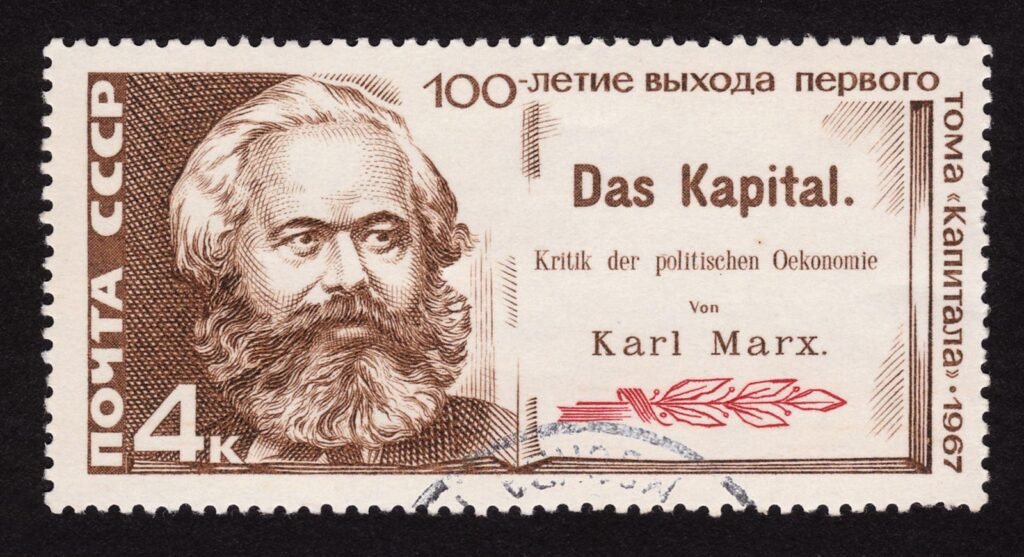

Canceled Soviet stamp (1967) commemorating the 100th anniversary of the issue of Capital … [+]

My skepticism about the 30-year mortgage to finance home ownership has grown, and it has become an intuition that, even if it could not be proven that the plan has created more problems than it has solved, it is a financing system that is in dire need of alternative solution. I think the alternative might be cooperative ownership models, hybrids of the monetization of property ownership with the communal concepts of collectivization. I half-jokingly call my thinking about it “experiments in limited forms of communism.” Can we create equity for individuals and families without highly risky forms of finance that are impossible for some to obtain and then once obtained, have distorting effects on economics and politics? I can’t fully answer this question here, but I want to start.

Last year I wrote a post titled, Is Home Ownership Still a Good Idea? which addressed the thought that mortgages tie people into a payment system for years as well as consuming land inefficiently. When I say “dangerous forms of financing” think of the disaster of 2008 and 2009. What happened then is that politicians’ grand promises of the “American Dream,” home ownership, facilitated lending practices that inflated a mortgage bubble that swallowed it. many millions of dollars and people when it collapsed. Without going into the details of this collapse, it is worth noting as I did that the collapse,

“It struck a chord with entrenched American populism on both the left and the right. On the left, this populism took the form of the Occupy Wall Street movement, an atavistic throwback to the socialism of the 1930s. It’s almost amusing to think back to the days when the word “socialism” was whispered about Obama and widely considered a slur, which must be rejected as strongly as questions about his birth. Today, the left embraces socialism. On the right, the Tea Party movement has buried the legacies of Alexander Hamilton and Henry Clay – funding and infrastructure – behind nativism and paranoia.”

There are also structural problems with mortgages that lead to wide disparities in ownership by race that are persistent enough to warrant concern. Here’s what the National Association of Realtors found about the gap between Black and White home ownership in the United States:

“While the U.S. homeownership rate rose to 65.5% in 2021, the rate among Black Americans lags significantly behind (44%), having increased only 0.4% over the past 10 years and is nearly 29 percentage points less than White Americans (72.7%). representing the largest black-white homeownership rate gap in a decade.”

According to the Urban Institute, the gap was 27% when the Fair Housing Act was signed in 1968. What’s going on? It is impossible to ignore the consistency in the racial disparity in the data. I looked at loan origination in one market, Albuquerque, in one year, 2021, and at the lowest income levels, the gap between Black and White mortgage applicants is about 11%.

There is a clear gap between Blacks and Whites when it comes to mortgage lending.

But when we look at mortgage loans at 120% of the area median income, about $90,000 of pretax income for a family of 4, the gap remains at about 8%.

The gap remains at higher income levels.

As I’ve pointed out before, poverty is concentrated among people of color and poverty means fewer dollars to manage which often means unpaid bills. Unpaid bills lead to low credit scores that negatively affect mortgage applications.

And what drives equity and drives housing policy? Lack of. Simply put, a mortgage only makes sense if home values are appreciating quickly, and that means a market with high demand and little supply. The premise of the 30-year mortgage is that the huge interest paid will be offset by inflationary pressures meaning higher rent costs for poor people. That is, when a family’s neighbors organize to oppose new housing, including apartments, they actually transfer wealth from the poor to their home value. When these apartments don’t get built, rents go up, but so does home equity.

How can cooperatives help dismantle this form of equity creation? I recently wrote about co-ops, an ownership model that essentially pools cash from multiple households to buy homes and then manage them efficiently. Imagine buying shares in a property with friends and family, say a 10 acre lot for $100,000 divided between 10 buyers at $10,000 per share. When the property appreciates, say by $1,000, then each owner’s share increases by $100. Take another step or two. What if a local government sold revenue bonds with a local tax, say on cannabis, used the proceeds to build a project, and then collected housing payments from a co-op to help retire that debt. It would look something like this.

A publicly funded co-operative housing scheme would be efficient and generate value for taxpayers … [+]

I need to do more work on this, but what this model of ownership would do is allow people to use their monthly housing payment to buy off the national debt, and with each payment the household would get closer and closer to owning a very low interest rate. Most importantly here, pooled household resources could easily pay off the bonds over a 15-year period, half the time it takes to retire a mortgage. And this form of equity building depends on families working together to offset operating costs. there is an equity component based on social capital that is not measured by conventional measures of risk and assets. Also, if a city uses all the tax revenue to retire the bonds, the homeowners’ payments can go into a revolving fund that can be put to work building more projects.

What I also like about publicly funded cooperatives is that the people who work every day borrow from other working taxpayers. These taxpayers see their money back and can see visible progress in producing more housing for people who need it. Yes, it sounds a bit like Marx’s slogan” Critique of the Gotha Program: “From each according to his ability, to each according to his need!” So what? The collective public risk of government-backed mortgages doesn’t work for many families, promotes bad public policy, and ties qualifying families to debt service for life. I am happy to leverage social capital and embrace collectivist branding if it leads to an outcome that creates more housing, more equity, closes the persistent gap between Black and White ownership and reduces the incentive for housing inflation .