China was under 20 percent of all U.S. soybean exports through October 2025, according to the most recently available U.S. Census Bureau data. For 14 of the last 17 years over the same time period, this percentage was over 40%.

ustradenumbers.com

For the first time in more than two decades, the United States did not export soybeans in the month of October, the traditional start of the export season, to the world’s largest market, China.

October was also an unprecedented sixth straight month of no U.S. soybean exports to China in at least three decades, according to the latest U.S. Census Bureau data.

It matters. U.S. soybean producers export about 55 percent of all soybeans they produce, either as whole beans or “crushed” meal form, which is the most common, or as oil, according to the U.S. Soybean Export Council.

Brazil, the world’s largest producer of the protein-rich legume that is largely used in meal form as feed for chickens, pigs and cows and then consumed by humans, recorded larger shipment to China in Augustat the end of its growing season.

U.S. soybean exports are one of the most visible signs of the trade war President Trump launched with China midway through his first term, when the U.S. deficit with the Asian manufacturing powerhouse was five times larger than with any other nation. But there are many more.

- China was the largest trading partner of the US. Today it is in third place.

- It will almost certainly end up below 10% of US trade for the first time in decades when annual figures for 2025 are released next month.

- For decades, China was the largest importer to the US. Now, he is in third place.

- Eight of the top 10 U.S. imports from China in 2018, when Trump first imposed tariffs on about $300 billion in U.S. imports, are down more than 50% today.

- For three of the last five months of last year, the largest US deficit was not with China, whose deficit was five times that of any other country in 2018, but with Mexico.

The US deficit, which declined sharply in Octoberhowever, it will almost certainly set a record when the annual figures are released, which would be the fourth record in Trump’s five years in office.

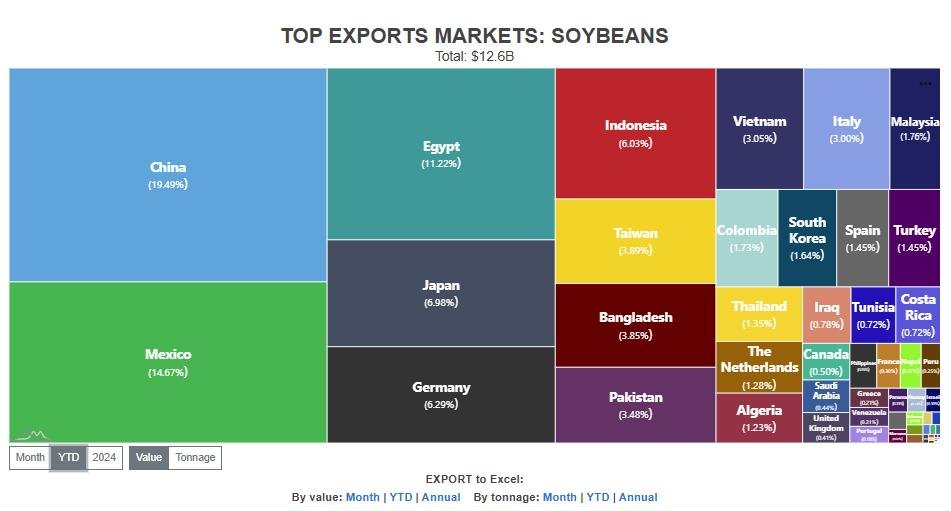

And, U.S. soybean exports to China, which accounted for more than 50% of all exports for 10 of the past 17 years and more than 40% for another four of those years, accounted for just 19% through October.

If China’s market share is not revealed to have grown, it will be the first year below 20% since at least 2003, the earliest available US Census Bureau data.

The chart shows the change from one year to the next, with 2019 showing a large increase after the initial impact of China (in red) pulling the plug on US exports in 2018 in the trade war situation, and 2025 reflecting the six-month drought.

ustradenumbers.com

All three of the last 17 years under 40% were with Trump in the White House. During both his first and second terms, the United States spent billions of dollars to try to cushion the blow to America’s soybean farmers.

Earlier this week, when I sought out an interview with Jim Sutter, CEO of the US Soybean Export Council, to talk about China and soybeans, he had just left Pakistan, now the ninth largest buyer of US soybeans, and was in Egypt, now ranked third. He had also visited Saudi Arabia.

“Just leaving Saudi Arabia today and optimistic about the prospects for US soybeans in this market,” he emailed Friday in the country currently ranked No.24. “The increasing availability of meals in the US – which is what Saudi Arabia is importing these days – and the strong relationship between the Kingdom and the US should help increase our share.

“It seems to be a place where quality and sustainability is something they care a lot about,” he wrote.

“Global demand for soybeans continues to grow,” said the organization’s communications manager, Erin Worrell. “As populations and economies grow, more people are moving into the middle class, and with that comes increasing demand for animal proteins such as poultry, eggs, pork and fish. Soy is an essential part of meeting this need through rations for these animals.

“Sustainability is another area worth highlighting. US soybeans have the lowest carbon footprint among major suppliers, and many countries and customers appreciate that,” he wrote. “We’re not increasing the amount of farmland in the U.S., but we’re producing more with less.”

The export council, like the farmers the union represents, 95% of whom are smallholders, are very familiar with the impact of the trade war with China on their exports – and their need for new buyers.

The chart shows the year-over-year change in US exports to Mexico, with 2025 showing a large increase (in red).

ustradenumbers.com

One of these countries is not so far away. Just as the U.S. deficit with Mexico is now slightly smaller than the U.S. deficit with China, so is the market share of U.S. soybean exports.

Mexico, the US’s largest global export and import partner, is now the second largest buyer of US soybeans, with 14.67% of the total. No country has been within 10 percentage points of China in more than two decades. the difference by October was 4.82 percentage points.

Since 2017, the year before China retaliated with tariffs on U.S. imports targeting soybeans, sales have fallen 70.27 percent, a loss of $5.821 billion. It left a big hole.

At the same time, necessarily, the total US exports to the world, while falling by 19.11% and 2.99 billion dollars, increased in other markets.

Egypt now ranks third among buyers of U.S. soybeans, with its strongest year through the first 10 months of 2025, according to the latest available data. The chart measures volume per tonnage.

ustradenumbers.com

Egypt is now the world’s third-largest buyer of US soybeans, having cracked 10% market share for the first time in 2025. By October, driven by record imports of $1.42 billion, that figure was 11.22%

Japan, Germany and Indonesia are all above 6%. Rounding out the top ten are Taiwan, Bangladesh, Pakistan, and Vietnam, all four accounting for 3% to 4% of US exports.

The latter three are all at record levels of market share, such as Egypt.

Indonesia’s 6.03% is second only to its 2024 total, while Germany’s 6.29% is second only to its 6.55% of its 2023 export total.

The hole left by China remains. In the first 10 months of 2017, the top 10, mainly due to China, accounted for 86.87% of the total. In 2025, the top 10 accounted for 78.95%.

“China is the largest importer in the world, without a doubt,” said Rosalind Leeck, managing director at the US Soybean Export Council. “But the rest of the world is growing. It’s a big opportunity across the rest of the world. With China, demand is still growing, but it’s growing at a declining rate.”

US exports to Egypt have increased by 390.34% since 2017. Exports to Germany have doubled, increasing by 103.79%. Exports to Vietnam increased by 73.61%. to Pakistan, 46.32%; and to Bangladesh, 31.19%.

For the nation’s soybean farmers, many of them clustered in the Midwestern states of Illinois and Iowa as well as Minnesota, Indiana and Nebraska, growing markets offer hope for their soybeans, which they generally rotate with crops such as corn, cotton and wheat.

The US-China trade rift has reshaped global soybean flows, forcing US farmers and exporters to cast a wider net. While China’s retreat has left an undeniable void, new markets from Egypt to Mexico are helping to fill it — not only diversifying demand but also strengthening strategic agricultural ties elsewhere. The era of dependence on a single dominant buyer may be giving way to something more resilient, even if the adjustment remains painful.