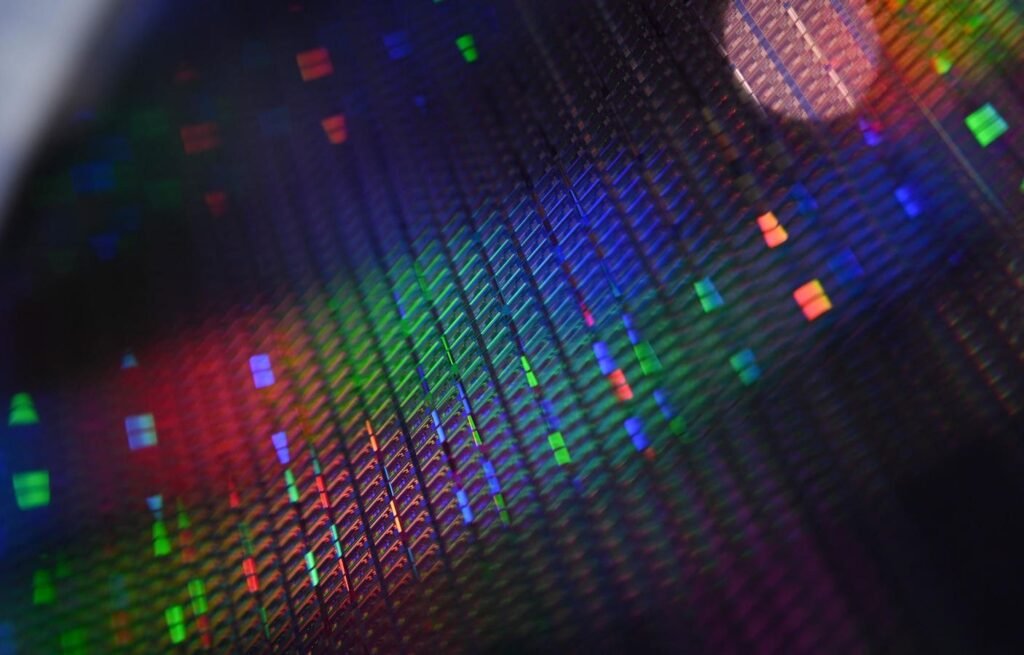

Arne Dedert/image alliance via Getty Images

Rigaku, a Carlyle-backed Japanese maker of semiconductor test equipment, tumbled in its Tokyo debut on Friday.

Shares fell 10.3 percent to ¥1,130 ($7.4), reducing its market capitalization to about ¥255 billion. They sold for ¥1,260 each, at the top of the price range. The IPO raised ¥112.3 billion (about $750 million), making it Japan’s second-largest IPO this year after subway operator Tokyo Metro’s ¥348.6 billion ($2.3 billion) deal , which was the country’s largest in nearly six years.

Founded in 1951, Rigaku manufactures tools used to measure semiconductor wafers and inspect them for defects and contamination. The Tokyo-based company also makes machines for the materials science and pharmaceutical industries.

For the 2023 fiscal year, Rigaku reported that revenue rose 27.4% year-over-year to ¥79.9 billion (about $525 million), while profit rose 141% from a year earlier to ¥15.3 billion. Rigaku makes a third of its revenue from the semiconductor and electronics industry. The company is benefiting from the increasing complexity of the chip manufacturing process.

Rigaku’s largest market is Japan, which contributes 31% of total revenue. Japan is an important link in the global semiconductor supply chain. The country is home to the billionaire Uchiyama family’s Lasertec (chip test equipment), KKR-backed Kokusai Electric (chip manufacturing equipment), Bain-backed Kioxia (memory chips), Renesas Electronics (automated chips), Tokyo Electron (chip manufacturing equipment), Advantest (chip test equipment), Sumco (silicon wafer supplier) and Shinko Electric (chip packaging).

Carlyle bought about 80% of the shares in Rigaku in 2021 for an undisclosed sum. The privately held giant’s other investments in Japan include KFC Japan, Orion Breweries, lighting and electronics company Iwasaki Electric, coated abrasives maker Sankyo Rikagaku, building materials company Senqcia and electrical cable maker Totuko.

MORE FROM FORBES