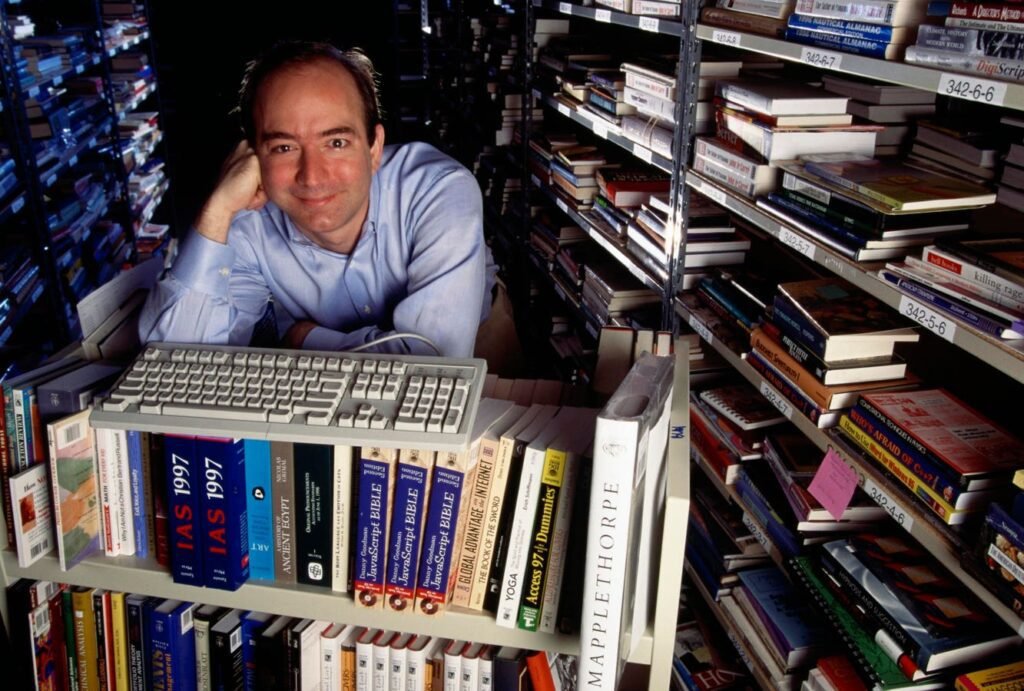

Bezos chooses books: Brilliance or luck?

Jeff Bezos invested $250,000 in Google in a very early round because he liked the entrepreneurs – Larry Page and Sergey Brin. Based on the success of this investment, one analyst suggests that the average investor may consider an online platform “for anyone who wants to contribute and grow with the emerging leaders in technology and business.”

Here are 4 factors that will help you understand Bezos’ smart abilities and decide whether you should consider investing through an online platform.

#1. Beating the odds at Amazon.com.

Since many of the smartest VCs had rejected Google, Bezos was either brilliant or lucky. Given his background, we can attribute his insight and determination to brilliance. He is said to have sifted through about 600 products before he chose books as Amazon’s first product, which was great because there is a huge list of books, most of which are not available in bookstores. He could also discount the price because he didn’t have the fixed costs of bookstores and the books could be shipped from the wholesaler. The key lesson for entrepreneurs: Find the right combination of emerging trend, product in the emerging trend, customer segment that will benefit most from the product in the emerging trend, and direct competitors that can be beaten with better execution. Bezos got his product lead, while other unicorn entrepreneurs were customer (Sam Walton, Michael Dell and Brian Chesky) or strategy (Bill Gates) lead.

#2. Invest in Google as an angel.

Not many small investors get to see ventures like Google because most home ventures are in Silicon Valley or seek high amounts per angel and it is impossible to identify a playbook like Google before there is proof of possibility. Bezos saw Google early because he had already started Amazon and was able to spot Google’s bright potential even though other, more experienced VCs had rejected Google. Since only 1 in 100,000 ventures becomes a home run it shows that Bezos was both brilliant and lucky.

#3. The odds of success investing through crowdfunding sites.

Here’s an example where entrepreneur, Palmer Luckey, did great selling his venture on Facebook. His crowdfunding angels didn’t do as well. The reality is that early stage VCs do well because they have the clout to control the venture and the resources to be the first mover in an emerging industry. Most of the others in the venture funding chain don’t do as well. Thus, crowds may have to be satisfied with non-financial returns. Crowdfunding sites are a great tool for entrepreneurs to raise funds from multiple investors without losing control. But whether these sites are great for investors is debatable. Since about 2% of VCs earn about 95% of VC profits suggests that 98% of VCs don’t earn much. And VCs have more leverage than crowds to negotiate a better deal. Early stage VCs often have the right to switch CEOs to hire professionals if the entrepreneur is not capable, and they invest much later than crowds and angels when the risk is significantly reduced. Few angels win in business financing.

#4. Chances of investment success if you invest because you like the entrepreneur.

Only if you have Bezos’ instincts – given that VCs, top early stage VCs fail in 80% of their deals. Most billion dollar entrepreneurs have succeeded because of their skills, but it is difficult to assess skills until there is proof of potential – not just a pitch deck. About 10 VCs rejected Apple because they were not impressed with Jobs, and the board fired Jobs. So, if you like entrepreneur, don’t hesitate to invest. But be prepared to lose your investment due to high risk. And be prepared for the entrepreneur to discount your interests when the venture can attract venture capital. Also, be prepared for the entrepreneur to find a “better class” of friends and family when the venture takes off.

MY OPINION: It would be great if the journalists promoting crowd funding and angel investing studied the possibilities and made sure that the crowds and angels are aware of the risks. There is a difference between buying a lottery ticket and “investing” all your savings in lottery tickets.

So, is Bezos smart or lucky? No one can deny that he is smart. But is he also lucky? She won the “ovary lottery” as Buffett put it so eloquently. Bezos was born in the right place, with the right genes and skills, and at the right time to jump on the emerging Internet trend for which he was supremely qualified. And Google turned out to be one of the greatest investments of all time. Is this brilliance or pure luck?