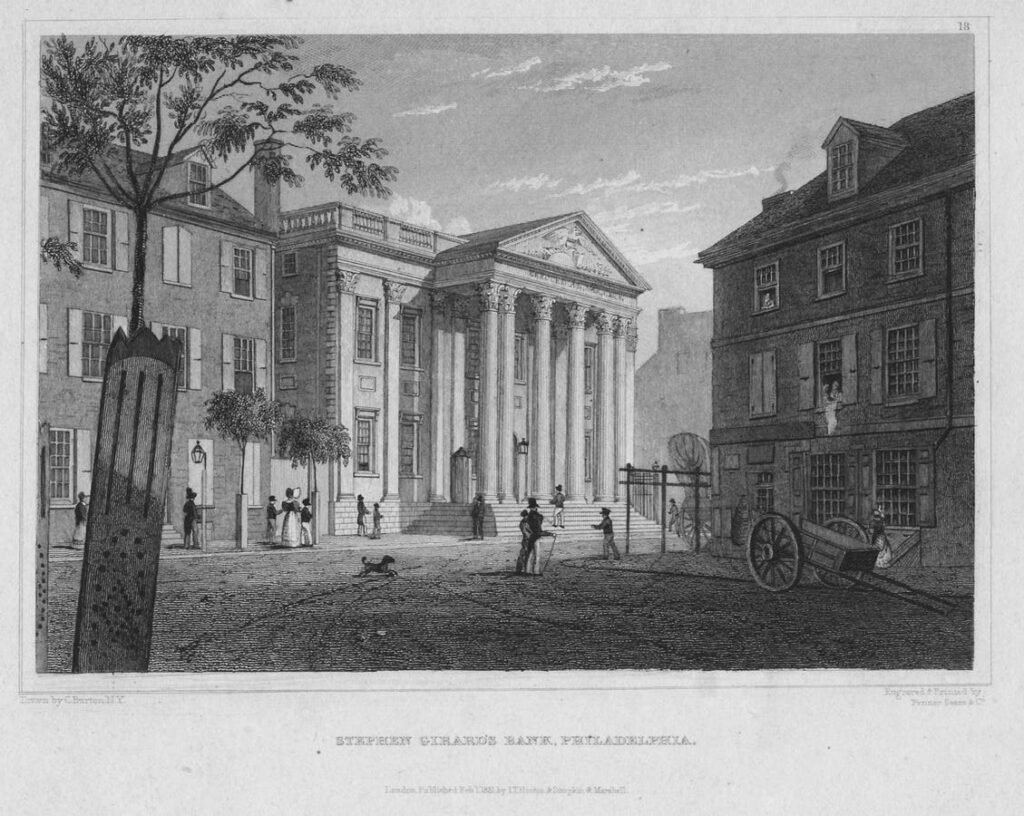

The Bank of Stephen Girard, Philadelphia (Photo with File Photos/Getty Pictures)

Getty pictures

It was just a golden age. American development and opportunities in times such as 1836-61 and 1865-1913-and even quite certainly, 1811-12-was epic. Robert L. Bartley, the god of the offer who ran the Journal Wall Street Constitutional Page in the 1980s, in 1992’s memoirs The seven years of fat He had a type of Mars in a portable way to get financial data. Bartley could not get straight answers from typical economists. “How was the recovery in the 1980s”, he would ask and take something like, “taking into account the relaxation, growth under Reagan delayed that of Carter and the Last Ford and culminated in the long -term in 1973”, etc. So in his book, he pretended to have a completely neutral one.

Let’s do it ourselves. “MartianWhat was the annual average increase from 1836-61? ”

**** 4.28 percent ****

“Mars, what was the average annual growth from 1865-1913?”

**** 3.71 percent ****

“Mars, what was the annual development from 1811-1812?”

**** 3.99 percent ****

This is fun!

The United States had nothing like a federal performance or a central bank (or a serious war) in these date series. The first and second Bank of the United States, Congress, the chartered institutions that look like modern central banks, existed from 1791-1811 and 1816-36. And by the way, growth was abundant under their routes – it must be noted because these banks had expiration dates. They should only run for twenty years and only twenty years. The nation knew that the central/government banks even when they existed were not permanent and acted accordingly by increasing.

When America did not have a central bank, it just made it big. Great, wonderful, wonderful. You can deal with GDP as a measure, but as a proxy, it works. Growth was great when the United States did not have central banking institutions. Four percent per year for decade in decade. The industries germinate and blossomed, the inventions are developing, the living standards for mass have always hit new heights. The claim that the pre-fed era was one of the repeated banking “panic” has no power. A banking system must be judged by real results. Do you have a big economy? Then you have a large banking system.

“Mars, what was the annual average growth from 2000-24?”

**** 2.12 percent ****

We have grown up for a quarter of a century in about fifty percent discount in times where we had nothing to look like a central bank. What benefits do the central banks again provide?

Who knows, so let’s ask another question. How did the incredible times, economically talk, do it with their non -central systems? This is a central question, which was investigated in detail, in our new book Free Money: Bitcoin and American Monetary Delivery.

In these glorious old times, the banks were created and operated like any other business. Attempted to provide a useful service. Their was to provide a safe haven for deposits and to provide currency and loans to an economy with huge quantities of potential transactions and real businesses. People needed a currency for loan transactions and loans for business opportunities. The banks provided both after receiving deposits. They made a profit in this business and everything was fine.

But banks did not give too much currency and did too much borrowing so they could get rich quickly while their depositors have been deceived; (performs the common modern objection). Is the average business in a size economy trying to deceive its customers? By definition, no. So not even these banks. If the economy grew up very well, something he did, the banking system was great.

The private regulation system was also large (of course). In Free moneyWe are discussing, in the federal period, the amazing bank of Stephen Girard, who from Philadelphia’s perch has ensured that banks with which businesses maintained proper practices. We are discussing, about the period after 1836, the apparent Suffolk bank system of the Great New England, with which the main bank maintained the reserves and the acceptable currency from the members of the alert eyes of integrity. How did it go? Growth numbers are not found.

The United States has just issued any dollars at this time. Congress offered a definition of a dollar, an ounce of silver or a twenty gold, and was pleased to watch all the parties make dollars as they considered appropriate based on this definition. Paper dollars issued by private banks redeemed at the home institution at home in precious metal. Private dollars issued by the bank were useful (more than currency in major cases) as transactions, just as bank credit was for business customers.

The whole thing functioned as a great wonderful organic body. Seeing the development of the country after 1865 is very amazing. Robert Gordon’s book The rise and fall of American development (2016), Cranky, as it is for the last twentieth century, and unknown, as it is for the new agreement, cannot help itself when describing the 1870s and 1880s. Rows and series of spacious houses with shipyards, all the new, tidy, as they can, He talks about “houses” in the big cities – and shows that they have dug the previous residence of housing in their spaciousness and convenience.

Even today in New York, an premium is placed on this property that is pre-war construction-the war of the world. This material was really good and remains like that. It is a legacy of the quality of the non -central bank.

The Fed controls inflation, so you must have it, an unjust banking system is cowboy capitalism, the public must have a lever in order not to control bankers and greed everything, the Fed rates, the Fed controls the money supply when we missed them, the economy was astral. If we want a stellar economy again, as we should, we need to restore the accusation. It is a private, self -regulating banking, which pushes its own theoretical institutions, as well as once, with Stephen Girard and Suffolk.