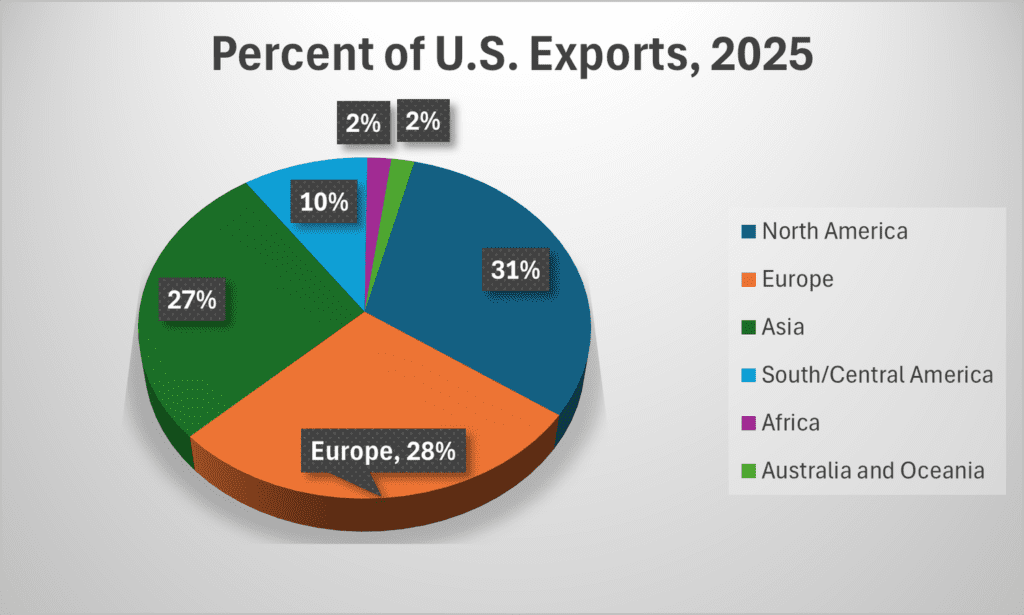

The percentage of US exports to Europe now ranks second only to USMCA parties Mexico and Canada, shown here as North America. That’s according to U.S. Census Bureau data through October, the most recent available.

ustradenumbers.com

For the first time since at least 2002, Europe is now the largest market for US exports from Asia, exposing the risk of a trade war with Europe for US companies and their workers as President Trump pushes to seize Greenland.

The United States and Europe are likely to arrive some kind of regulation On Wednesday, however, Trump did not release details and said he was not sure if Denmark, which controls Greenland, was aware of any deal.

There were many reasons for Trump to retreat from military might and from imposing tariffs, as he apparently did when he arrived at the World Economic Forum in Davos, Switzerland.

What the White House may not have known is that Europe accounted for 28 percent of all U.S. exports through October, according to the latest available U.S. Census Bureau data, while Asia accounted for 27 percent. USMCA partners Mexico and Canada accounted for 31%.

This is a significant change from when Trump first took office, before he started the trade war with China. In 2017, Asia accounted for 31% of US exports to 22% for Europe, with then-NAFTA trading partners Mexico and Canada accounting for 34%.

When Trump took office for his first term in January 2017, Europe was a distant third by region, with North America (Mexico and Canada) and Asia well ahead.

ustradenumbers.com

Both Asia and North America have lost three percentage points while Europe has gained six percentage points since 2017.

Two of those six percentage points were gained during Joe Biden’s presidency, while four have been gained in the first nine months of Trump’s second term, from February to October.

A key reason for Europe’s gain is the uncertainty Trump has created with his trade policies and other decisions. His search for Greenland is but one example. The impact is clearly seen in the price of gold, which skyrocketed last year best year in decades.

This is traditionally a sign that investors are looking for a safe haven in stormy weather. Increasingly, central banks around the world are increasing their holdings of gold as they seek the same safe haven. This desire to hold gold is seen as a sign of reduced confidence in the US dollar as the world’s reserve currency.

As a result, US gold exports have accelerated significantly this year, with three-quarters going to Switzerland and the UK, accelerating growth in Europe as a market for US products.

The value of US gold exports soared in 2025, with its value nearly double the previous record for the first 10 months of the year.

ustradenumbers.com

Another factor has increased US LNG exports to Europe to counter Russia’s gas boycott following its invasion of Ukraine, a war that is still raging.

The top US exports to Europe through October last year, accounting for 44.19% of the total, were:

- gold

- civil aircraft

- oil

- vaccines, plasma and other “fractions” of blood

- liquid natural gas

- hormones and steroids

- medicines in pill form

Due to US gold exports in 2025, the difference in growth rates by region is stark. Through October of last year, US exports to Europe were up 21.44% from the same 10-month period in 2024. US exports to Asia were up 0.40% and exports to North America were down 2.55%. US exports to the world rose 5.52%. (2025 US imports from Europe have increased 14.17% compared to the same period in 2024.)

In dollars, total export numbers through October are as follows:

- North America, $562.14 billion

- Europe, $509.78 billion

- Asia, $499.97 billion.

Annual trade figures will be released next month, though the U.S. Census Bureau has yet to release a date, continuing to respond to last summer’s government shutdown.

Since Trump took office in 2017, US exports to Europe have increased by 274%, while those to Asia have increased by 210.20%. US exports to Mexico and Canada increased by 28.77% and to the world by 42.49%. (The United States’ two largest export markets are Mexico and Canada, despite slower growth.)

While US exports to Europe account for 28% of all world exports, the US deficit with Europe represents slightly less than 20% of the US deficit with the world. Put another way, US trade with Europe is more balanced than US trade with the world.

Indeed, the United States runs a trade surplus with some of its largest European trading partners:

- the United Kingdom, at a record pace, with a US surplus of $24.79 billion

- the Netherlands, also at a record pace, at $49.48 billion, although it is largely a transshipment hub for the rest of the continent

- Belgium

- Spain, also at a record pace

- Turkey, with the US on track for the first surplus since 2016

- Lithuania

- Greece

- Ukraine

- Luxembourg

The UK has been the top US export market to Europe for all but three years since 2002 and was narrowly ahead of the Netherlands until October. As with the Netherlands, it also acts as a transshipment hub. It is also a destination for gold shipments to the US.

Switzerland and the United Kingdom received more than three-quarters of all U.S. gold exports, by value, through October of last year.

ustradenumbers.com

The Netherlands ranked first in the previous two years and three of the previous four.

Switzerland passed France, Italy and Belgium to rank third among US export markets, largely due to these gold shipments.

France, Italy, Belgium, Spain, Ireland and Turkey complete the top 10.

At No. 11 is Poland, the top former Eastern European member of the Soviet bloc. U.S. exports to Poland grew a bit more slowly last year, up 22.47 percent, but those exports are up 1,946 percent since 2002, seven times the rate of the rest of Europe.

Europe’s rise as a destination for American goods is no spreadsheet curiosity. It’s a wake-up call that trade policy decisions now resonate louder in the Atlantic than in the Pacific.

As Europe and Washington weigh new tariffs, sanctions or even symbolic battles over territory while trying to reach a solution, it is clear that US exporters are increasingly tied to European demand. A trade war with Europe would not just test diplomatic ties with longtime allies, but jeopardize the very markets that have quietly become the most important driver of U.S. export growth in recent years.